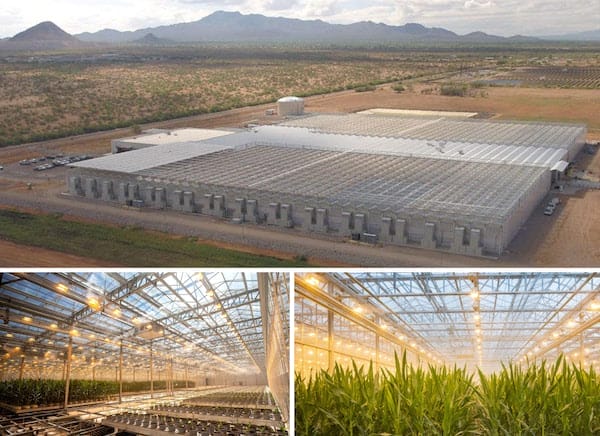

Recently Sold - Bayer-Monsanto Seed Production Facility, Marana, AZ

Thomas Company is pleased to announce the sale of a Bayer/Monsanto seed production and innovation facility in Marana, Arizona, totaling +/- 436,000 square feet. The list price was $111 million. The asset was structured as a zero-cash-flow investment, with long-term fixed rate CTL financing. The property was also subject to a 99-year prepaid ground lease, allowing the investor to depreciate their entire cost basis. The purchaser was attracted to the asset due to the financial strength of the tenant/guarantor, the in-place assumable mortgage, and the passive losses generated by the investment.

Recently Sold - Safeway Grocery Store, Lacey, WA

Thomas Company is pleased to announce the sale of a Safeway grocery store in the Olympia, WA MSA. The tenant had executed a 20-year absolute-net lease with fixed rent increases, providing the investor long-term, stable cash flow. The purchaser was seeking exposure to the Pacific Northwest region and was attracted to the property’s essential business use.

Albertsons Companies, LLC (“Albertsons”, or the “Company”) is the 2nd largest traditional grocer in the United States serving over 34 million customers per week and generating $60 billion in sales annually. As of June 2017, the Company operated 2,329 stores across 35 states under 20 well-known banners with long operating histories.

Recently Sold - CVS Zero-Cash-Flow Portfolio Transactions

Thomas Company is pleased to announce the sale of two CVS zero-cash-flow portfolio transactions, sold to the same purchaser. The first transaction included 7 triple net lease properties, totaling +/- 93,400 SF, and closed in April 2020. The second transaction included 6 triple net lease properties, totaling +/- 75,000 SF, and closed in May 2020. Each of the assets has a 25-year lease and in-place assumable mortgage that fully amortizes coterminously with the lease. Each of the leases are structured as bondable triple-net (NNN), with no landlord responsibilities whatsoever. The purchaser was a real estate developer who was attracted to the unique tax benefits of the investment structure and the passive losses generated by the investments.

Recently Sold - McLendon Hardware, Sumner, WA

Thomas Company is pleased to announce the sale of a +/- 32,600 square foot McLendon Hardware store located in Sumner, WA. The tenant executed a 20-year, triple net lease in 2017 with 2% annual escalations. The sale represents the fourth McClendon Hardware asset sold by Thomas Company on behalf of our client.

McLendon Hardware is a fourth-generation, family-owned retailer operating in Washington’s Puget Sound region. The company has built a loyal following through its dedication to excellent customer service and extensive product selection, winning awards including the Angie’s List Super Service Award, 425 Magazine’s “Best Hardware Store” listing, and a best-value nod from Checkbook.org’s non-profit consumer reports.

Recently Sold - McLendon Hardware, Seattle MSA

Thomas Company is pleased to announce the sale of a +/- 117,830 square foot McLendon Hardware located in Renton, WA, which is part of the greater Seattle metropolitan area. McLendon Hardware executed a 20-year, triple net lease when the property was constructed in 2017.

Seattle is the largest city in the Pacific Northwest region and the fastest-growing American city of the past decade, with an 18.7% population increase since 2010. As of 2018, the Seattle–Tacoma–Bellevue MSA was home to an estimated population of 3.94 million, comprising more than half of the state’s total population. It is the 15th largest MSA in the United States. In 2018, Forbes Magazine ranked Seattle #1 on their list “Best Cities for Business and Careers.”

Thomas Company Hires Ben Smith

Ben joined Thomas Company in August 2019. As Associate Director, Ben’s primary role consists of sourcing new business opportunities and representing developers, owners, and investors in the disposition of net leased assets across the United States. This includes property due diligence, sourcing purchasers of net leased properties, and client relationship management.

Prior to Thomas Company, Ben worked with a non-profit developer in Seattle where he analyzed nearly $1 billion in potential developments and sourced debt financing for active projects over all property types. Prior to that he was a part of a brokerage that specialized in sourcing and aggregating individual investment properties to sell to investors.

Ben is a graduate of the University of Washington’s Michael G. Foster School of Business where he obtained a Bachelor’s of Business Administration with a focus in Information Systems. Ben is a member of NAIOP, and a licensed Washington State real estate broker.

Thomas Company Negotiates Sale of 61-Property CVS Portfolio

Thomas Company is pleased to announce the completed individual sales of a 61-property CVS portfolio. All properties within the portfolio were offered unlevered and free and clear of debt. Each store has a 25-year, absolute triple-net (NNN) lease in place with no landlord responsibilities and no rent holidays.

All stores are recently constructed or have been recently renovated and are located throughout the U.S in 28 states. Combined, the properties total more than 807,000 square feet of retail space.

CVS Health Corporation (S&P: BBB, NYSE: CVS), together with its subsidiaries, is one of the largest pharmacy health care providers in the United States with integrated offerings across the entire spectrum of pharmacy care. As of June 2017, CVS operated 9,700 retail stores in 49 states, the District of Columbia, Puerto Rico, and Brazil under the CVS pharmacy name. CVS Health continues to show strong growth and earnings.

Thomas Company Negotiates Sale of Industrial Distribution Center

Thomas Company recently led the negotiations and closing of a 968,250 square foot office distribution center fully leased to Supervalu, Inc, (NYSE: SVU) which has merged with United Natural Foods (NASDAQ: UNFI) to create America’s premier food wholesaler. The property is located on approximately 52 acres of land in the greater Chicago area of Joliet, IL.

The property was sold with a 20-year lease which commenced at the close of escrow. It included rent increases throughout the term and five, five-year options to extend. The absolute triple-net (NNN) lease with no landlord responsibilities provides the investor with truly passive ownership.

This state of the art industrial distribution center was built in 2009. A construction grade building, the interior is divided into dry storage, refrigerated storage, and necessary support areas in the warehouse area, as well as general and private office space. The building offers 110 dock doors and 150 trailer spots with 33% of the space being temperature controlled. In addition, the clearing height is approximately 34 feet. It is situated in a primary Chicago industrial submarket with convenient access to Interstate 80, a transcontinental highway.

In addition to this recent transaction, Thomas Company has successfully executed more than $5.6 billion worth of single-tenant transactions, continuing to deliver superior results for our clients.

Net Lease Stays Steady

By Joe Gose, Shopping Center Business

Jeffrey Thomas was recently featured in the May issue of the Shopping Center Business story, “Net Lease Stays Steady.” Read the excerpt below:

The best price of debt for the best net lease properties with investment grade tenants already has increased some 25 basis points to around 4.25 percent from last year, says Jeffrey Thomas, founder of Seattle-based Thomas Company. And they’re only going to rise from there, he predicts.

“The speed at which those changes can occur can slow things down because there’s going to be a disconnect between buyer and seller expectations,” he cautions. “We know people that have a real need to transact, but they’re taking time to digest some of these investments, especially the larger deals.”

While sellers over the past several months have largely refused to budge on price, Thomas says that some are beginning to quietly re-engage previously interested buyers with sweetened deals. That typically marks the start of a broader re-pricing process, he adds.

Read the full article at Shopping Center Business >>

Thomas Company Arranges Sale of Orgill INC. Industrial Distribution Center

With more than $5.6 billion worth of single-tenant transactions executed successfully, Thomas Company continues to deliver superior results for our clients with the sale of a freestanding industrial distribution center.

Situated on 31.4 acres of land in Post Falls, Idaho, this customized facility covers over 465,000 square feet and is fully leased by Orgill, Inc. The triple-net lease commenced in August of 2017 and the property was offered as a zero-cash-flow investment with fully amortizing debt in place.

This property is Orgill’s seventh full-service distribution center. Recent renovations added 25,000 square feet to the property and included the installment of material-handling, inventory tracking and storage systems.

Orgill, Inc. is the largest independently- owned hardlines distributor in the world, and one of the largest privately-held companies in the United States. The company was recently praised for bringing over 130 new jobs to Post Falls with this distribution center, and was recognized for its positive community impact at the Trade & Industry Development 12th Annual Corporate Investment and Community Impact (CiCi) Awards.

Thomas Company is proud to have led the negotiations and closing of this property.